FISCAL 2021: FIRST QUARTERLY REVIEW

Celebrate the Wines of British Columbia reviews the work of Wine Growers British Columbia (WGBC) and its member wineries during each quarter of the fiscal year. This first quarterly review covers activities that occurred during April, May and June 2021.

Miles Prodan, President & CEO

President & CEO Report

A MESSAGE FROM MILES PRODAN

Most, if not all, wine producing regions use public policy levers to advance their domestic industries. A companion to the WGBC’s Annual Advocacy, Communications and Marketing Operational Plan is our FY22 Government Advocacy Priorities to align Government Policy objectives with Wine Growers British Columbia’s Wine BC 2030 Long-Term Strategic Plan and to demonstrate how existing Government Programs can be utilized or expanded to achieve the objectives and create a robust wine industry. More specifically, the WGBC board approved the Advocacy Committee’s recommendations that focuses on Government priorities in relation to:

More specifically, the WGBC board approved the Advocacy Committee’s recommendations that focuses on Government priorities in relation to:

- Job Creation and Economic Development

- Climate Change

- Indigenous Reconciliation

- Crown Corporations Secretariat

- Agriculture

- Tourism

And with the specific objectives:

- Support of the Wine BC 2030 Long-Term Strategic Plan through the alignment of public policy with industry to ensure the ongoing quality and profitability of BC wine.

- Increase direct and indirect employment in the sector by 4,600 jobs from the current 8,300 to 12,900.

- Increase by $165 million revenue to Government through direct taxes paid through business income, payroll, property taxes and fees.

- Make up for the ~$20 million lost to the industry through the government decision to implement and make permanent full wholesale price for hospitality customers in BC.

- Maintain the high standards for health and social responsibility that exist today to encourage irresponsible consumption.

Most importantly, WGBC FY22 Government Advocacy Priorities looks to achieve the objectives by:

- Expand market share and margins for BC wines

- Lower input costs

- Re-focus/consolidate and make better use of existing Government Programs

- Improve synergies with the BC LDB and private retailers

- Recognize the imperative of climate change and UNDRIP

I invite you to follow our progress of our government advocacy work as reported in each quarter. – Miles

Kim Barnes, Marketing Director

Marketing Director Report

A MESSAGE FROM KIM BARNES

As we evaluate the past year and move forward with Fiscal 2022, the importance of supporting local continues to rise to the top in all WGBC initiatives. To strengthen the connection of the BC Wine Industry with consumers, trade and media, a journalistic storytelling thematic was developed to share the story of BC wine throughout the seasons from the “wine-farmers” perspective. A Year in the Life of BC Wine: Programming throughout the year will align with A Year in the Life of BC Wine and supports the achievement of WGBC Fiscal 2022 Strategic Goals of Brand and Demand and the associated objectives as outlined below in this quarterly report.

Laura Kittmer, Communications Director

Communications Director Report

A MESSAGE FROM LAURA KITTMER

Fiscal 2022 began with a vision to re-engage with trade, media and consumers planning to visit and support BC wine country during the first tourism season after a year of evolving COVID-19 restrictions. Our communications efforts during Q1 were driven by our brand goals, in support of our advocacy and demand strategies: new industry GI topographic maps were launched; key media and trade were hosted for WGBC’s annual Vintage Media Preview to promote the 2020 vintage; wine trade professionals became BC Wine Ambassador Level One certified; and updated COVID-19 communications tools and resources (WGBC Ready to Reopen Toolkit version 2.0 and 3.0) were developed and delivered to align with BC’s COVID-19 four-step Restart Plan. Our tactics were purposeful and targeted – designed to capture trade, media, industry and consumer interest in all phases of the purchase funnel, and bring them from awareness to highly engaged brand advocates benefiting all WGBC members.

FISCAL 2022

STRATEGIC GOAL #1: BRAND

The BC brand informs everything the industry does – from communications to education, from marketing to hospitality. Every BC wine touch point is an opportunity to reinforce the core of BC’s brand identity as a wine region. Building industry alignment reinforces these touch points in the marketplace leading to increased awareness and positive perception of BC wine and regions.

STRATEGIC OBJECTIVE #1: BUILD A WORLD-CLASS BRAND FOR WINES OF BRITISH COLUMBIA

| 1.1 Wines of British Columbia materials and messaging will be adopted by 10% of WGBC’s membership and utilized in their marketing materials and communication with consumers, media and trade. | ON TRACK |

| 1.2 Consumer image and awareness perception of Wines of British Columbia will increase by 2%. | ON TRACK |

| 1.3 International and domestic media coverage will increase by 20% in advertising equivalency over FY21 with a 10:1 return on unpaid media coverage. | ON TRACK |

1.1 Q1 RESULTS

Wines of British Columbia materials and messaging will be adopted by 10% of WGBC’s membership and utilized in their marketing materials and communication with consumers, media, and trade.

LIVING THE BRAND

Workshop delivered to the Marketing and Communications Committee for final feedback, implementation of the program forthcoming.

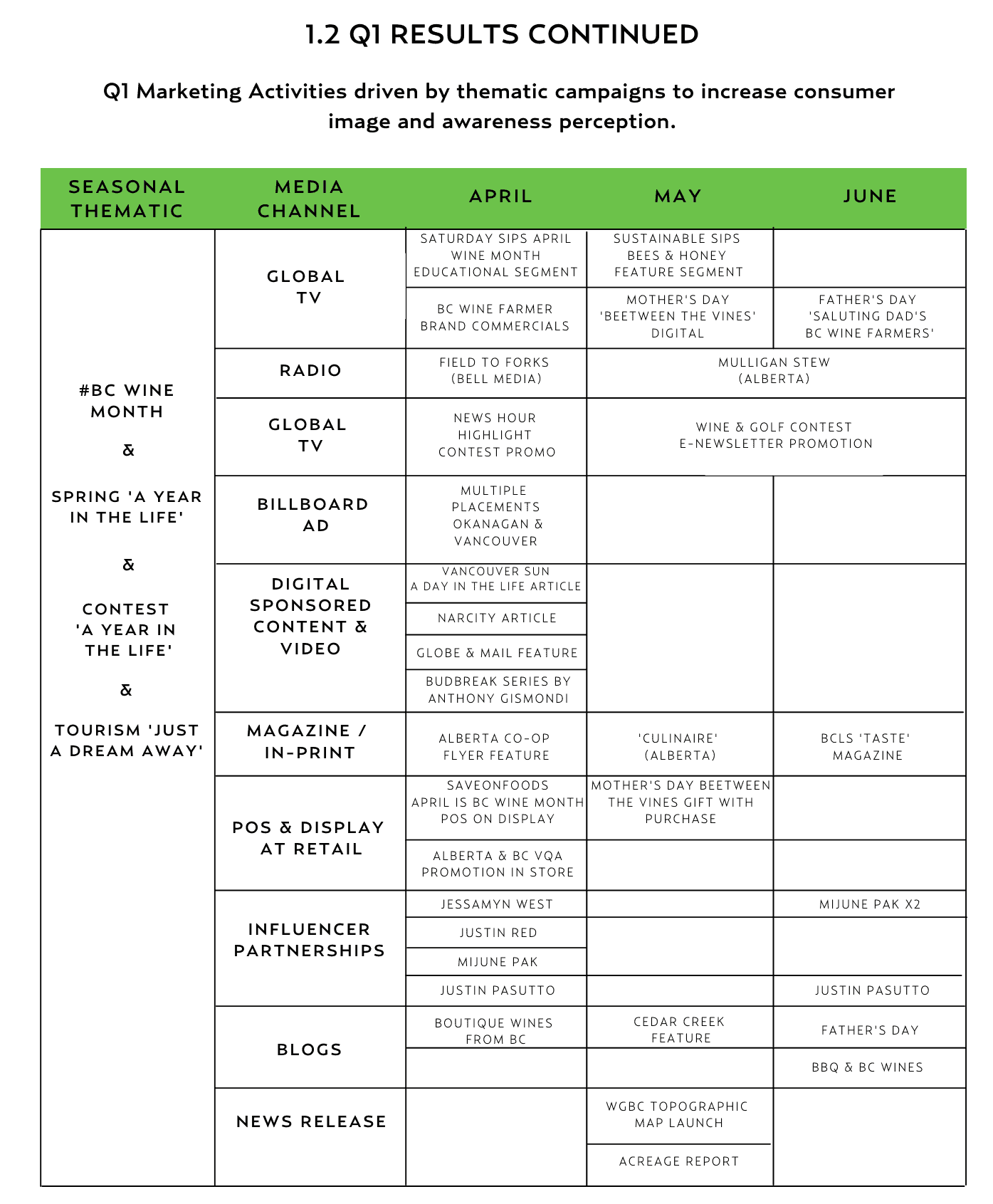

1.2 Q1 RESULTS

Consumer image and awareness perception of Wines of British Columbia will increase by 2%.

WINEBC.COM

Year over year Q1 2021 vs Q1 2020 the WineBC.com website saw a slight decrease in visitation likely driven by additional and more stringent Covid-19 restrictions put in place in British Columbia. In June we saw a rebound of interest from consumers with the lifting of restrictions after the May long weekend, therefore the overall quarterly shortfall was a marginal -8.28%.

THE VINE E NEWSLETTER

High value marketing for the brand: allowing WGBC to engage on a personal level with BC wine drinkers. Goal set to provide monthly or bi-monthly articles, videos, contests, and educational components designed to inspire and inform.

Q1 saw an increase in subscribers by 575. This increase is attributed in part to Q1 contest campaigns orchestrated as a growth tactic. In Q1, WGBC sent three newsletters to 25k+ active database subscribers with an average open rate of 33% (benchmark 20%), and a total of 5k+ click conversions, or an average click-through rate of 4.2% (benchmark 2%).

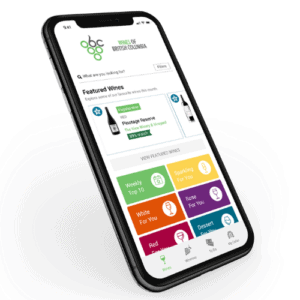

CONSUMER EXPLORER APP

The Wine of BC Explorer App continues to evolve, gaining 1.5k+ new users in Q1 for a total of just under 12k users, 3k of them active during this period, with 105k engagement actions and 2k+ direct click throughs to member winery websites.

1.3 Q1 RESULTS

International and domestic media coverage will increase by 20% in advertising equivalency over FY21 with a 10:1 return on unpaid media coverage.

DIRECT & INDIRECT MEDIA COVERAGE

Coverage of Wine Growers British Columbia, its members and the Wines of British Columbia reached 204.7 million readers and viewers from April 1 – June 30. Value for media coverage totaled $1,893,927. Read more: Q1 Media Report

Total earned social media from influencer engagement and initiatives amounted to more than $3 million with 152 posts and 32,116 engagements. Read more:Q1 Influencer Media Report

BC WINE MONTH

- 3 online media partners

- 2 influencers

- 1 media release

- 34 media sample drops

These PR and marketing efforts helped generate 31 articles and 152 social media posts supporting and promoting BC Wine Month and BC member wineries, for a total reach of 13.4 million and $3 million in unpaid national and international media coverage.

GI TOPOGRAPHIC MAPS LAUNCH

This new resource enables consumers and trade/industry alike to be engaged and informed. Developed through collaboration with local consulting soil scientist Scott Smith, and a Geo Earth Mapping consultant. Available at WineBC.com.

VINTAGE 2020 MEDIA PREVIEW

WGBC hosted a virtual two-part webinar preview of BC’s 2020 vintage, gaining earned media exposure for the new spring release wines. Streaming live from the wine regions and vineyards of British Columbia – media, trade and industry were invited to join our host, Master of Wine Barbara Philip and two panels of BC winemakers from across the province as they provided an in-depth review and discussion of the 2020 vintage. Media samples were sent to key media in advance, engaging an audience of 96 media, trade, and industry attendees from across the country.

PRESS RELEASES

To ensure the Wines of British Columbia stay top of mind in key markets and to make sure consumers and industry remain informed on issues affecting the wine industry, Wine Growers British Columbia regularly issues press releases to a group of more than 300 national and international media.

Average open rate for media releases sent to media, trade, and stakeholders within this first quarter of Fiscal 2022 was 34%. The average open rate industry standard sits at 23%.

All press releases issued in Q1 available in the Media section of WineBC.com.

MEDIA TRAINING

WGBC conducted a three-hour virtual media training session for WGBC member wineries, facilitated by Senior Vice President of global public relations agency FleishmanHillard HighRoad, Jackie Asante. Utilizing the Wines of British Columbia Living the Brand materials, this interactive training session focused on providing winery spokespersons with the technical skills and techniques in delivering a media interview or presentation including: the importance of owning and knowing when NOT to own questions; understanding the “three D’s” (defer, deflect and deliver), tips for interview preparation, messaging techniques and effective message delivery, and how to develop ‘bridges’ from any questions you may be faced with.

WGBC is always looking for a diversity of winery spokespeople to participate in our media initiatives, whether it be on a panel, a FAM tour, an interview, or a winemakers’ dinner. Webinar recording and presentation are available at WineBC.com.

FISCAL 2022

STRATEGIC GOAL #1: BRAND

STRATEGIC OBJECTIVE #2: POSITION BC AS A PREMIER WINE REGION WITH THE TRADE

| 2.1 Trade image and awareness perception of Wines of British Columbia will increase by 2%. | ON TRACK |

2.1 Q1 RESULTS

Trade image and awareness perception of Wines of British Columbia will increase by 2%.

AMBASSADOR PROGRAM LEVEL 1 VIRTUAL LAUNCH

- 13 trained wine educators (facilitator team)

- 33 virtual sessions

- 4 private sessions for Earls Restaurant head office and staff members

- 6 private sessions for Sobeys / Safeway Liquor Store staff

- 432 wine industry professionals in BC and Alberta certified (111 retail, 98 winery staff, 16 media, 149 restaurant and 58 wine industry)

WGBC reached 90% of overall goal to certify 500 trade, media, winery and restaurant professionals by end of fiscal-22 in just the first quarter. Satisfaction with Level 1 and appetite for Level 2 was evident in post-event feedback from participants.

Testimonials for the Ambassador Program:

“Just wanted to write and say thanks so much to all of the organizers at Wine Growers British Columbia and to the excellent wine professionals teaching the Wines of BC Ambassador Program today! It was so informative, well presented and fantastic!”

BC WINE MONTH TRADE TOOL KIT

Deployed to trade partners, communicating access to print and social assets available for marketing use. Resulting in a win-win for the BC wine brand and industry stakeholders to work together to engage and encourage consumer purchase of BC local wine. Hashtags #BCWineLife and #BCWine brought all social content together, with tremendous engagement:

#BCWine = 4.71k

#BCWineLife = 1.19k

FISCAL 2022

STRATEGIC GOAL #1: BRAND

STRATEGIC OBJECTIVE #3: BUILD BRAND BC IN LEADING EXPORT MARKETS

| 3.1 Activate 2021-2023 WGBC Wine Export Strategy year one route-to-market objectives. | ON TRACK |

3.1 Q1 RESULTS

Activate 2021-2023 WGBC Wine Export Strategy year one route-to-market objectives.

STEP BY STEP RESOURCE GUIDE TO EXPORT

WGBC successfully secured funding through the B.C. Agrifood and Seafood Market Development Program to develop these to help promote and export BC wines internationally. The guides will include concise information and a step-by-step process to export for each of our six priority international markets as identified in the 2021-2023 WGBC BC Wine Export Strategy.

WGBC engaged Terroir Consulting to begin developing these guides, gathering research and conducting interviews with trade commissioners, exporting wineries and key influencers in target markets. The first “step-by-step” export guide to the UK market was presented to the WGBC Export Committee for input and feedback.

ENTER THE NORWEGIAN WINE MARKET BRIEFING 10 STEP BY STEP RESOURCE GUIDE TO EXPORT

WGBC is working closely with the Norwegian Trade Commissioner Service to develop programming and in-market opportunities for BC wineries to access and establish a presence for BC wines in this market.

Offered virtually, hosted by the Trade Commissioner Service and featuring local experts on the Norwegian market as well as representatives from the Norwegian Wine Monopoly (Vinmonopolet). The webinar provided BC wineries with key insights on Norway’s wine sector including opportunities and challenges of doing business in Norway, market intelligence and more. Webinar recording available to all interested member wineries.

FISCAL 2022

STRATEGIC GOAL #1: BRAND

STRATEGIC OBJECTIVE #4: MAKE BC WINE COUNTRY A BENCHMARK FOR WINE TOURISM

| 4.1 Increase winery direct sales by 5% | ON TRACK |

| 4.2 Increase Wine and Food Tourism digital engagement by 25%. | ON TRACK |

| 4.3 Develop a model for tracking Wine and Food Tourism winery visits. | IN PROGRESS |

4.1 Q1 RESULTS

Increase winery direct sales by 5%.

WGBC has successfully secured matched funding through the DBC Co-op Marketing program to promote Wine and Food Tourism throughout FY22.

TOURISM SECTOR PARTNERSHIPS/COLLABORATIONS

WGBC continues to work with the BC Hotel Association to promote and elevate overnight stays in BC Wine Regions through the Booking Platform developed in FY21 as part of this ongoing partnership and collaboration. Destination British Columbia further incorporated the Booking Platform on their Hello BC’s things-to-do, wine touring page providing additional lift and awareness. A successful collaboration between Golf BC, WGBC, Thompson Valley Winery Association and Kamloops Tourism ran over the months of April through June with a BC Wine and Golf Contest resulting in over 10,000 entries and the opportunity to cross promote BC Wine and Golf touring throughout the province.

4.2 Q1 RESULTS

Increase Wine and Food Tourism digital engagement by 25%.

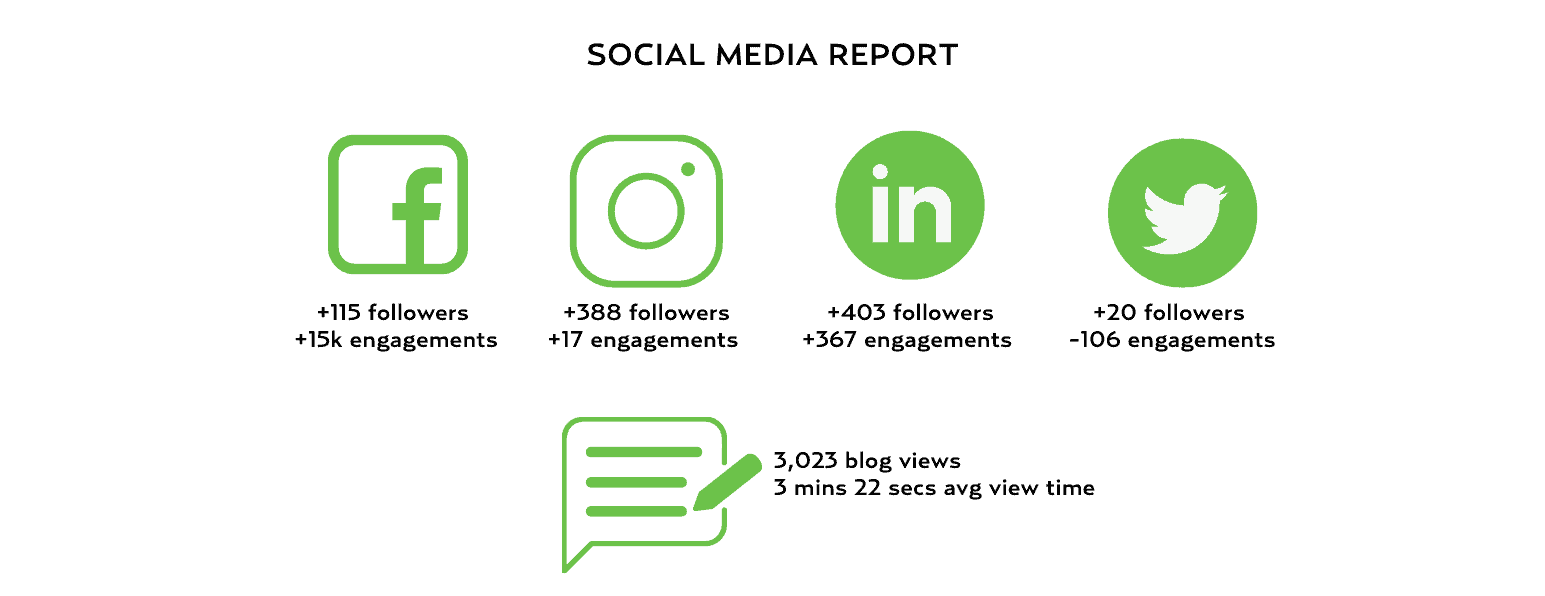

SOCIAL MEDIA REPORT

Wines of BC engaged social media influencer Mijune Pak to optimize LIVE Instagram video interviews with 7 member wineries for the spring campaign to highlight the new vintage.

Q1 featured seven blogs earning 3,023 total page views with an average page visit time of 3 minutes and 22 seconds, telling us we have a highly engaged audience who are appreciating the relevance of our content. Topics included the Boutique Wines programming, high value BC wines, consumer-friendly BBQ pairings and chef’s recipes, the Moms and Dads of the BC wine industry, and celebrating National Indigenous Peoples’ Day.

WINE GROWERS BRITISH COLUMBIA EXPLORER APP CONSUMER UPTAKE

DIGITAL AD BUYS

STRATEGIC GOAL #2: ADVOCACY

STRATEGIC OBJECTIVE #5: STRENGTHEN WINE INDUSTRY LEADERSHIP

| 5.1 Continue to work on COVID-19 recovery plans for industry. | ON TRACK |

| 5.2 Membership engagement will increase by 5% in all WGBC communications, programs, and events. | ON TRACK |

5.1 Q1 RESULTS

Continue to work on COVID-19 recovery plans for industry.

THE REOPEN TOOLKIT VERSION 2.0 & 3.0 RESULTS

Wine Growers British Columbia is on track to continuously support this objective through providing resources delivering up-to-date communications tools and resources to industry, setting members up for a safe and successful tourism season. The toolkit includes; refined key messaging, winery/hospitality best practices for tours and tastings, as well as recommendations for diversifying and enhancing winery offerings. This resource came together through a collaborative effort between WGBC, the Provincial Health Officer, Destination British Columbia, British Columbia Restaurants and Foodservices Association and Liquor and Cannabis Regulation Branch.

ADVOCATE FOR INDUSTRY WITHIN CONTEXT OF COVID-19 RESTRICTIONS

Working through the Business Technical Advisory Panel (BTAP) committee, WGBC advocated to have manufacturer tasting rooms to sample product inside a manufacturing facility for the purpose of purchase excluded from the April “Circuit Breaker” restrictions – essential for the recovery of wine industry tourism in BC.

5.2 Q1 RESULTS

Membership engagement will increase by 5% in all WGBC communications, programs, and events.

HIGH ENGAGEMENT AND ADOPTION OF Q1 WGBC CONTENT/TRAINING:

- 11 webinar training events serving just under 3k participants

- 13 weekly update e-newsletters – with a high open rate of 44% and avg 145 clicks/newsletter

- 10 CEO updates – with a high open rate of 49.7% and avg 112 clicks per newsletter

- 33 online sessions of the newly certified BC Wine Ambassador Program Level One

- Certifying 98 industry/member participants

PARTICIPATION IN INTERNATIONAL WINE COMPETITION CONSOLIDATION

The more industry participation in international wine competitions, the more recognizable BC wine country will be as a premium region known for high quality and standards. Membership participation was outstanding in Q1:

- 3 international competitions received consolidated shipments of 100% BC wine (Decanter World Wine Awards, Cascadia Wine Competition & International Wine & Spirit Competition)*

- Directly resulted in 257 top accolades in Q1 – additional commendations and accolades available to review on WineBC.com

* WGBC planned to consolidate for this quarter cancelled: Pacific Rim International Wine Competition (due to COVID-19); and Los Angeles International Wine & Spirits Competition (cancelled indefinitely)

WINE GROWERS BRITISH COLUMBIA EXPLORER APP INDUSTRY UPTAKE

GROWTH IN MEMBERSHIP WITH WINE GROWERS BRITISH COLUMBIA

+4 New Members in Q1: Blasted Church, Four Shadows Vineyard & Winery, Fox & Archer and Horseshoe Found.

+ 6 New Associate Members in Q1: Frind Estate Winery, Castoro de Oro Estate Winery, Meadow Vista Honey Wines, Lonetree Old Growth Orchard, Maan Farms, and Northern Lights Estate Winery.

Full Member and Associate Member List available on WineBC.com.

STRATEGIC GOAL #2: ADVOCACY

STRATEGIC OBJECTIVE #6: ALIGN GOVERNMENT ADVOCACY EFFORTS

| 6.1 Establish a WGBC Board Advocacy and Membership Committee (AMC) for alignment priorities. | COMPLETE |

| 6.2 Align strategic priorities and shared initiatives across industry organizations. | ON TRACK |

6.1 Q1 RESULTS

Establish a WGBC Board Advocacy and Membership Committee (AMC) for alignment priorities.

BOARD APPROVED COMMITTEE

FY22 Government Policy Objectives recommendation in support of WGBC Wine BC 2030 Long-Term Strategic Plan. Committee to demonstrate how existing government programs can be utilized or expanded to achieve the objectives and create a robust and sustainable wine industry via: Expanded market share and margins for BC wines, lowered input costs, improved synergy with BCLDB private retailers, and recognition of the importance of climate change and UNDRIP.

6.2 Q1 RESULTS

Align strategic priorities and shared initiatives across industry organizations.

CONTINUED FISCAL ADVOCACY

Achieved through continued support for the Wine Grower Quality Enhancement Program in Federal Budget 2021, as well as WGBC’s continued efforts for the implementation and extension of the federal excise tax support program.

STRATEGIC GOAL #2: ADVOCACY

STRATEGIC OBJECTIVE #7: INCREASE VALUE OF BC WINE THROUGH CERTIFICATION

| 7.1 The BC Wine Authority (BCWA) plebiscite process and results will be advocated for and supported. | ON TRACK |

7.1 Q1 RESULTS

The BC Wine Authority (BCWA) plebiscite process and results will be advocated for and supported.

MODERNIZATION OF BC LCRB LICENSE AND BC LDB DISTRIBUTION AGREEMENTS

To recognize all certified 100% BC wine as equal, including the implementation of outstanding BCWA July 2016 Plebiscite Results.

STRATEGIC GOAL #3: DEMAND

Work with BC Liquor Distribution Brand (BCLDB) to build prominence and visibility of certified 100% BC grape wine in retail channels, while increasing demand for 100% BC wines in premium price categories.

STRATEGIC OBJECTIVE #8: STRENGTHEN WINE INDUSTRY LEADERSHIP

| 8.1 Grow BC VQAs average price point in between $20 – $39.99 by $0.10. | ON TRACK |

| 8.2 Increase BC VQA provincial litre market share over $20 by 3.5%. | ON TRACK |

8.1 Q1 RESULTS

Grow BC VQAs average price point in between $20 – $39.99 by $0.10.

DATA BASED RESULTS IN Q1 based on YOY increase of $2.30 (YTD)*

| Q1 average of $26.85 in target price band ($20 – $39.99) | |

| April | $25.40 |

| May | $29.58 |

| June | $25.58 |

*Based on a 20% markup View more data through previous sales reports: April May June

PRICE BAND PROGRAMMING SUPPORT

38 wineries submitted for consideration, 7 selected.

‘Boutique Wines’ Programming in BCLS, developed in conjunction with BC Liquor Stores to support BC wine industry by presenting and promoting smaller lot wines to add to the seasonal, regional and brand diversity of our local industry.

8.2 Q1 RESULTS

Increase BC VQA provincial litre market share over $20 by 3.5%.

THE OVER $20 PRICE BAND IS SHOWING A 1.79% INCREASE IN MARKET SHARE FOR THE BC VQA CATEGORY AS OF THE END OF Q1

For the wider wine category all price bands increased in market share with the exception of $30-$34.99 which saw a decline of -3.85% Q4 – Q1. The over $100 price band had the most dramatic increase of 10.96%.

STRATEGIC GOAL #3: DEMAND

STRATEGIC OBJECTIVE #9: SECURE AND IMPROVE ACCESS TO THE BC MARKET

| 9.1 Increase premium positioning for 100% BC grape wine in retail channels. | IN PROGRESS |

9.1 Q1 RESULTS

Increase premium positioning for 100% BC grape wine in retail channels.

RETAIL CHANNEL SPECIFIC PROGRAMMING

for high-profile placement and value-add/gift with purchase incentives:

- BCLS = Boutique Wines

- Save-on-Foods = Bee Sustainable campaign

PROVIDE ACCESS TO WGBC MARKETING MATERIALS

Program is in test and learn stage, evolving through industry feedback.

Uptake on collateral through LRS (ex. Decals on floors)

Success measure through Digital Marketing Toolkit Downloads

Q1 downloads =